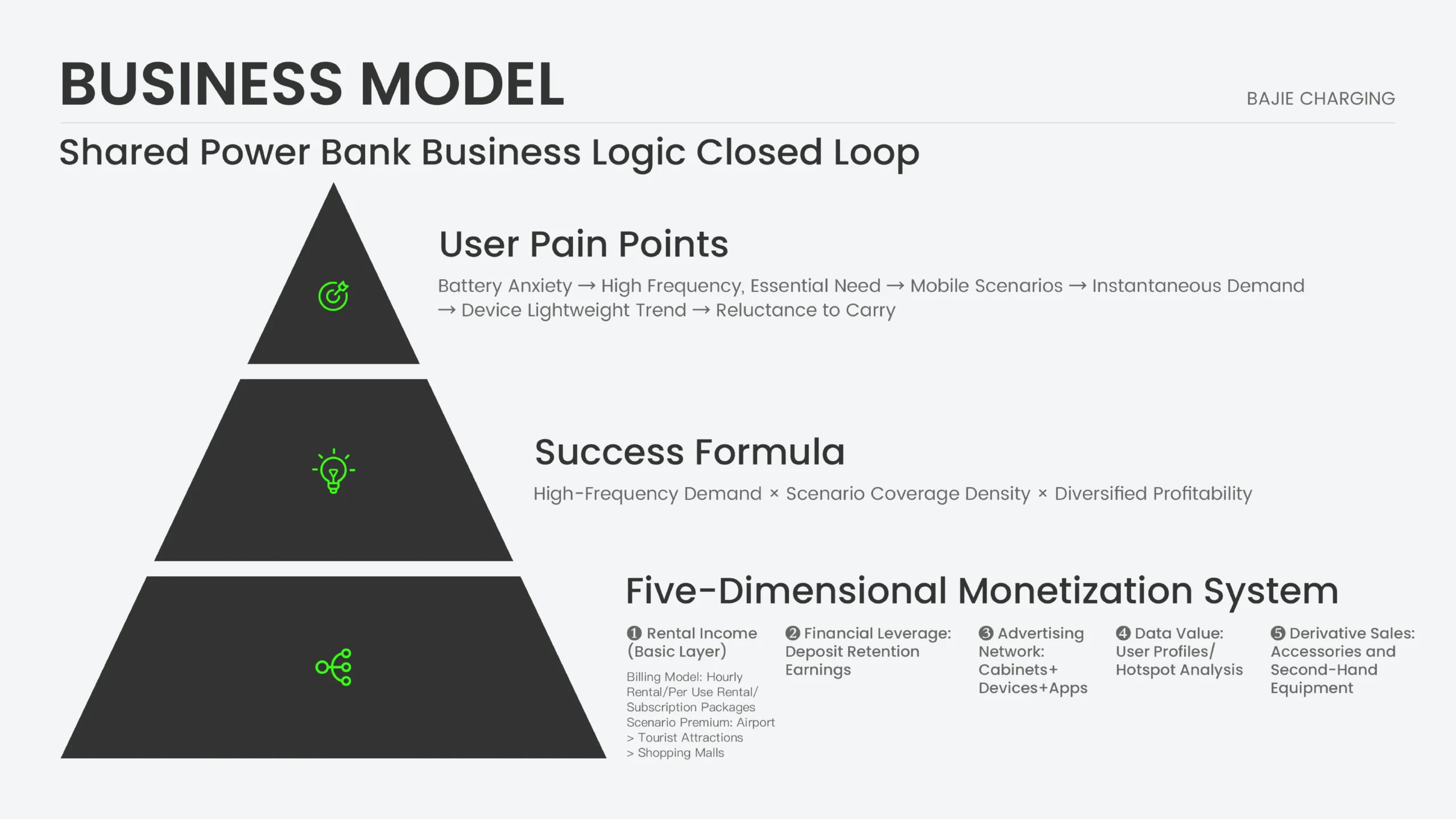

Smartphones have become the center of people’s lives, work, and social communication. “Battery anxiety” has become a common pain point among global users. The power bank rental station provides an innovative solution to mobile device charging challenges. This business model not only brings convenience to users, but also opens new revenue opportunities for investors.

The widespread adoption of smartphones has made information access, social interaction, mobile payments, entertainment, and leisure more convenient. Whether for business trips, leisure activities, or daily commuting, the problem of insufficient mobile device battery power is becoming increasingly common.

Phone charging lockers, deployed in public spaces, provide convenient mobile charging services that relieve users’ “battery anxiety.” With simple steps, users can rent a shared power bank anytime and anywhere to recharge their devices. Investors generate income through multiple channels, including rental fees, advertising revenue, value-added services, and product sales.

1. Why can shared power banks become a profitable business?

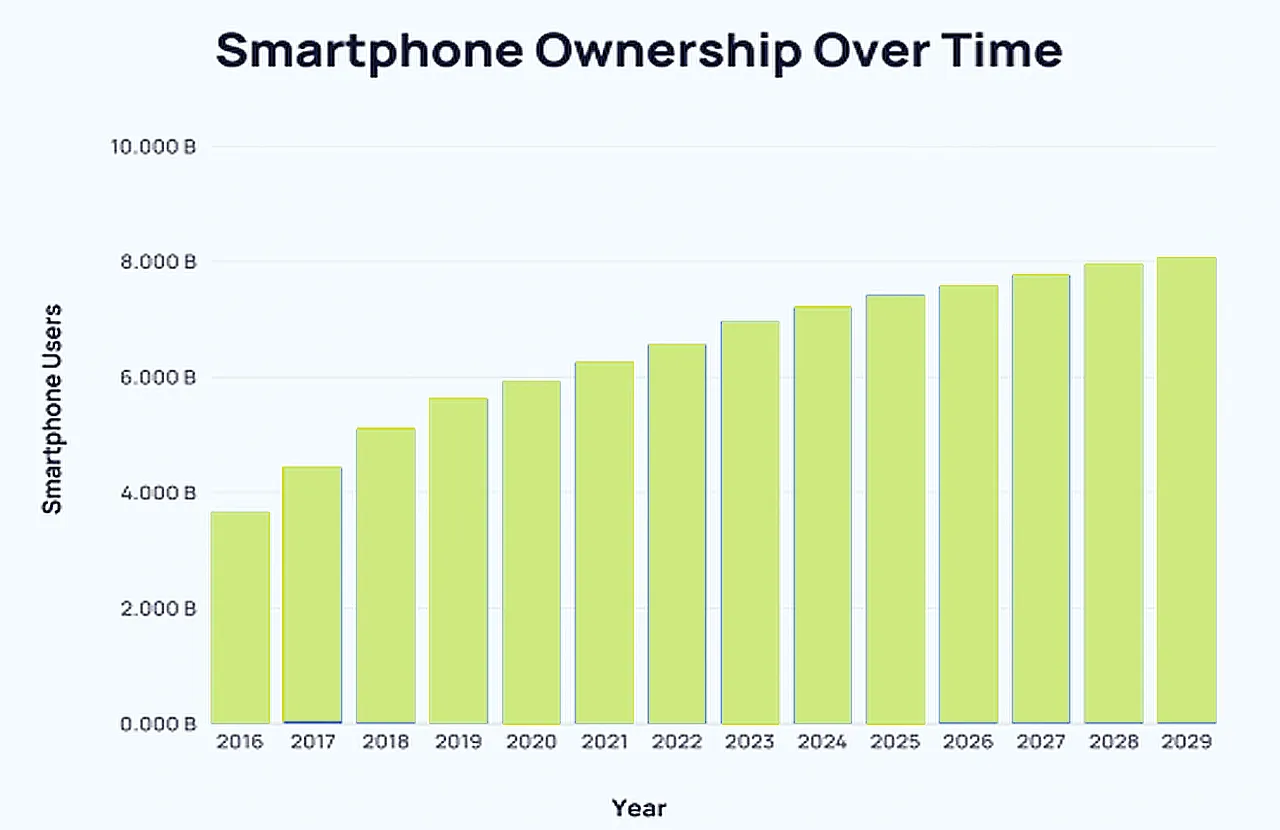

Global smartphone penetration is high and continues to grow. It is estimated that by 2029, the number of smartphone users worldwide will reach approximately 8.064 billion. The global rental power bank market has grown rapidly due to the popularity of smartphones and users’ increasing reliance on mobile devices.

Demand for temporary charging is rising across travel, social activities, and outdoor scenarios. Rental power banks, as portable charging solutions available on demand, provide power to smartphones, Bluetooth earphones, and other electronic devices anytime and anywhere.

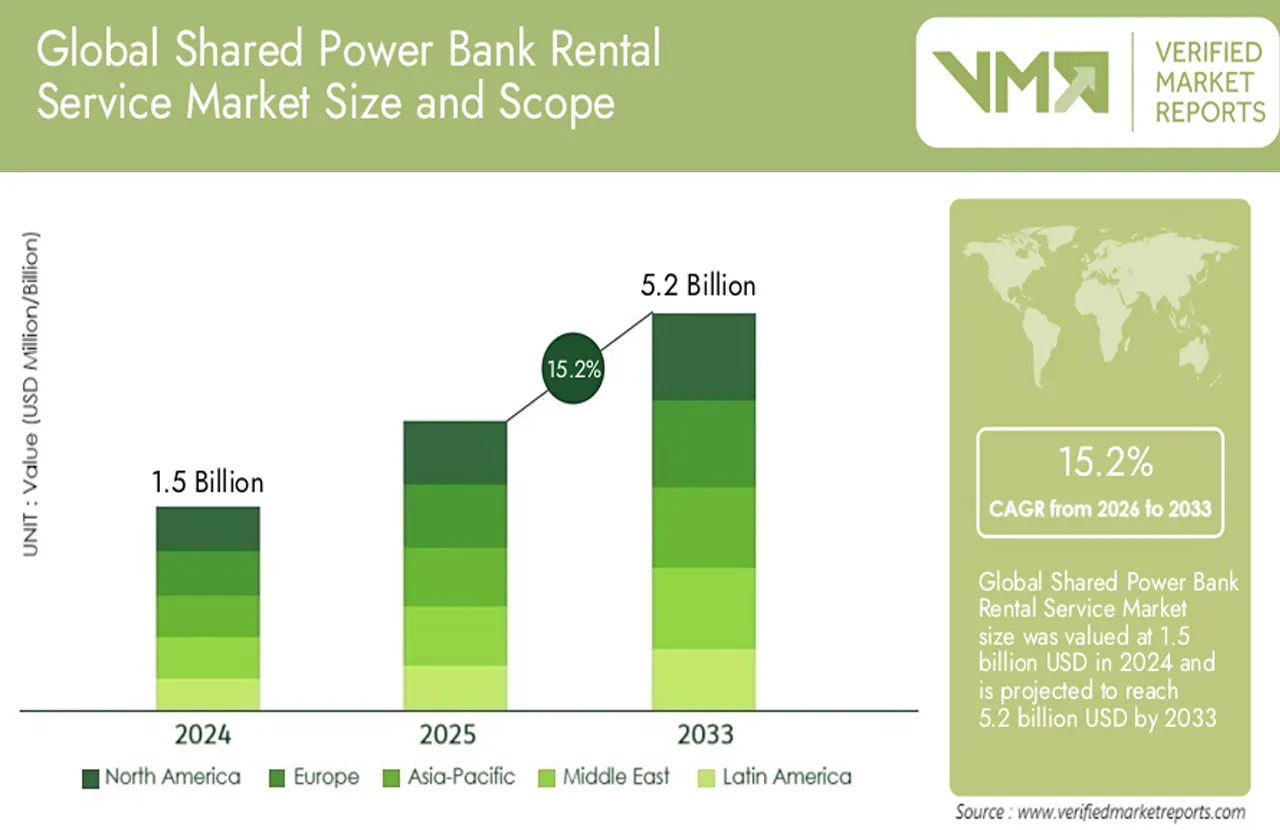

According to Verified Market Reports, the power bank rental station market was valued at USD 1.5 billion in 2024. The market is expected to grow rapidly, reaching USD 5.2 billion by 2033, with a compound annual growth rate (CAGR) of 15.2% from 2026 to 2033.

In many overseas regions, public charging infrastructure has low coverage and limited accessibility, making it difficult for people to find power outlets. Factors such as urbanization and booming tourism have driven surging charging demand in public venues. Shared power banks provide a flexible and convenient charging solution to meet user needs in mobile settings.

Power bank sharing is widely distributed across shopping malls, restaurants, and transportation hubs. Although growth in China has slowed slightly in recent years, the large market size continues to support upward expansion. Meanwhile, Southeast Asia, North America, and Europe have become fast-growing regions for cell phone charging stations.

2. What are the revenue streams of mobile phone charging stations?

- Rental Income

Rental fees are typically calculated based on duration, usage frequency, or package plans. Time-based charging follows hourly/half-hour billing. Power bank rental packages include daily and weekly options, allowing users to purchase charging time or usage bundles at a discounted price.

Different locations—such as restaurants, shopping malls, or transportation hubs—may apply differentiated pricing strategies. During high-demand periods (weekends, holidays, or special events), flexible pricing can further increase revenue.

- Advertising Income

Cabinet advertising: Power bank cabinets placed in high-traffic locations deliver strong brand exposure, supporting image and video displays. The front, side panels, and other areas of the cabinet function as ad placements to maximize visibility.

In-app advertising: Brand advertisements and promotional campaigns can be displayed on the mobile app interface.

Power bank body advertising: Ads can be printed directly on the power bank units.

By leveraging user location data, rental history, and usage frequency, power bank rental operators can support precise advertising and brand collaboration, improving ad performance and revenue.

- Financial Leverage (Deposit Float Income)

Capital float: The rental deposit generates temporary capital inflow, which can be used for short-term financial operations or working capital.

Deposit collection: A refundable deposit is charged during rental.

Deposit-free trend: Credit-based rentals reduce user barriers and increase conversion rates. However, in most overseas markets with multi-currency payments, pre-authorization holds are more common.

- Value-added Service Revenue

In-app services: Coupons, memberships, local service recommendations, and lifestyle offers help increase user engagement and drive incremental revenue.

Brand partnerships: Collaboration with local businesses—such as food delivery or ride-hailing platforms—creates additional income streams.

- Data Analytics and Service Revenue

Merchant foot traffic analysis: Rental and return data can be used to analyze customer flow trends for merchant partners.

User profiling: Behavioral and geographic data support precise user segmentation for marketing services.

Customized data solutions: Tailored analytics reports and insights can be offered to brands.

- Product Sales

Accessory sales: Charging cables, fast chargers, display racks, storage bags, and other accessories.

Refurbished equipment: Used devices can be refurbished and resold. Through offline cabinets and online channels, operators build a circular ecosystem to recycle and reuse equipment resources.

3. What key factors influence the portable charging station business?

Power bank stations located across multiple venues provide charging access for mobile devices, meeting immediate power needs. Deploying equipment in restaurants, shopping centers, transportation hubs, and entertainment venues increases usage frequency and revenue.

High network density of phone charging vending machines allows easy rental and return, improving convenience and encouraging more users to join. Long-term partnerships with high-traffic venues strengthen distribution advantages.

Differentiated location planning—covering transport hubs in large cities and commercial districts in smaller towns—captures charging needs more accurately. Extensive point-to-point coverage enables users to easily access charging.

Equipment maintenance and operational management depend heavily on the technology platform. Smart management systems monitor device status in real time, track usage and deployment, and support remote troubleshooting to reduce costs.

Continuous product iteration—fast charging, wireless charging, remote management, predictive analytics, intelligent alerts, and improved user experience—helps maintain competitive advantage.

Conclusion

Shared power bank rental stations generate revenue through time-based rental fees, advertising, deposit float, value-added services, and product sales. Rental income helps investors cover operating costs and achieve rapid returns. Advertising on equipment placed in high-traffic areas increases marketing revenue.

Membership systems, local service integration, and in-app sales expand the value-added ecosystem. Deposit float supports short-term capital gains. Accessory and device sales further diversify income streams.

High usage frequency, large-scale deployment, and refined management enable economies of scale—more mobile charging stations mean higher utilization and lower unit cost.

The diversified profit model of phone charging stations helps investors quickly recover costs at prime locations. Standardized operations enable rapid market expansion, and consistent consumer demand ensures long-term passive income and strong ROI.

December 1, 2025