Smartphones have become an essential part of daily life. From social interaction and entertainment to mobile payments, work communication, and navigation, they permeate almost every aspect of modern living. As phone functions continue to expand and usage frequency keeps rising, “battery anxiety” has become a common global issue. Mobile phone charging stations provide users with convenient, on-the-go charging solutions, while also creating highly attractive business opportunities for investors. Beyond rental income, what other revenue streams can shared power banks generate?

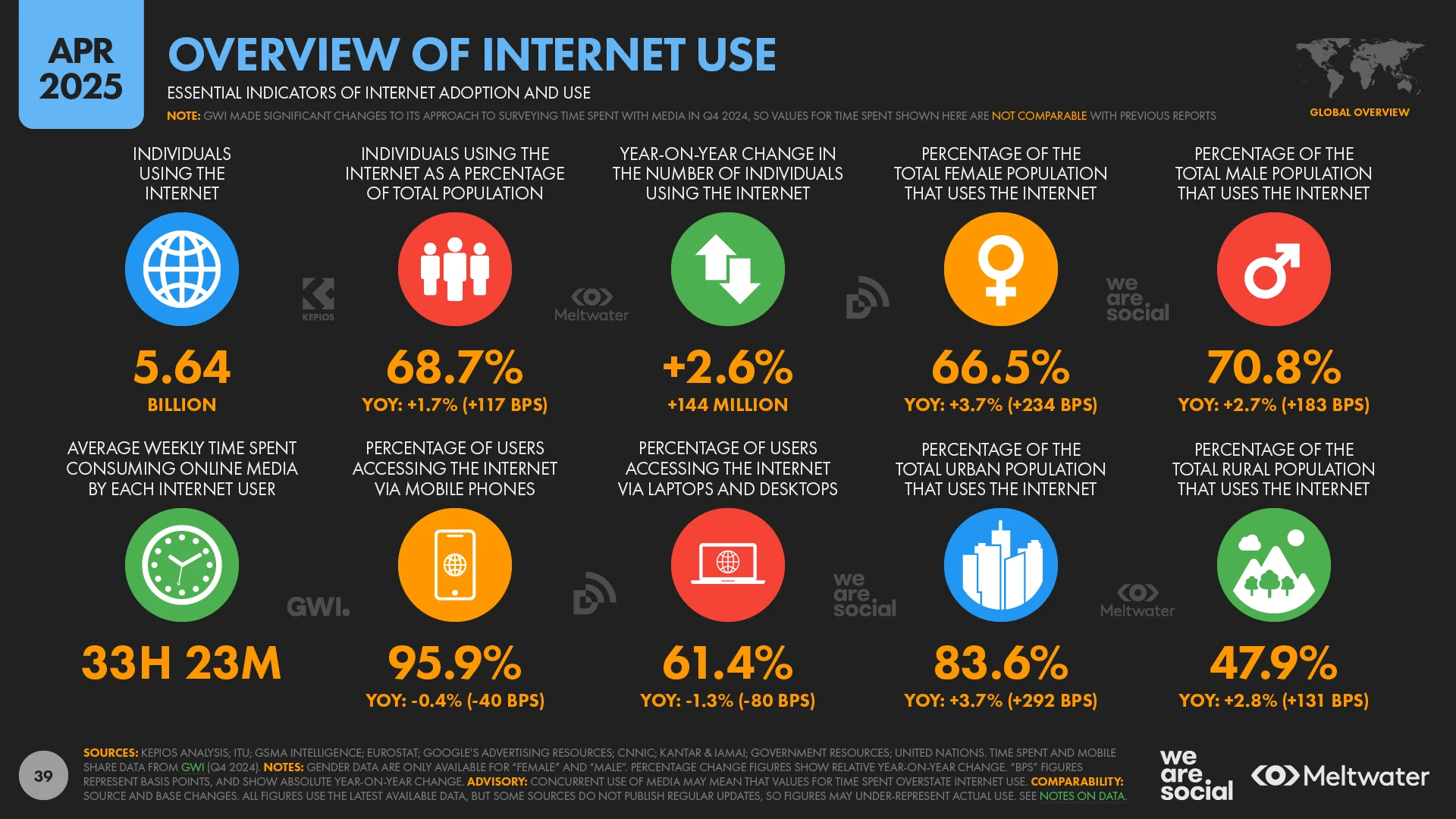

According to the latest data from Meltwater, the global number of internet users reached 5.64 billion in 2025. Each internet user spends an average of 33 hours and 23 minutes per week on online media, and 95.9% of users access the internet via mobile phones. People’s daily lives, work, and entertainment are inseparable from smartphones. Limited battery life has made battery anxiety widespread. As a result, the global shared power bank market is growing rapidly, driven by users’ increasing dependence on mobile devices.

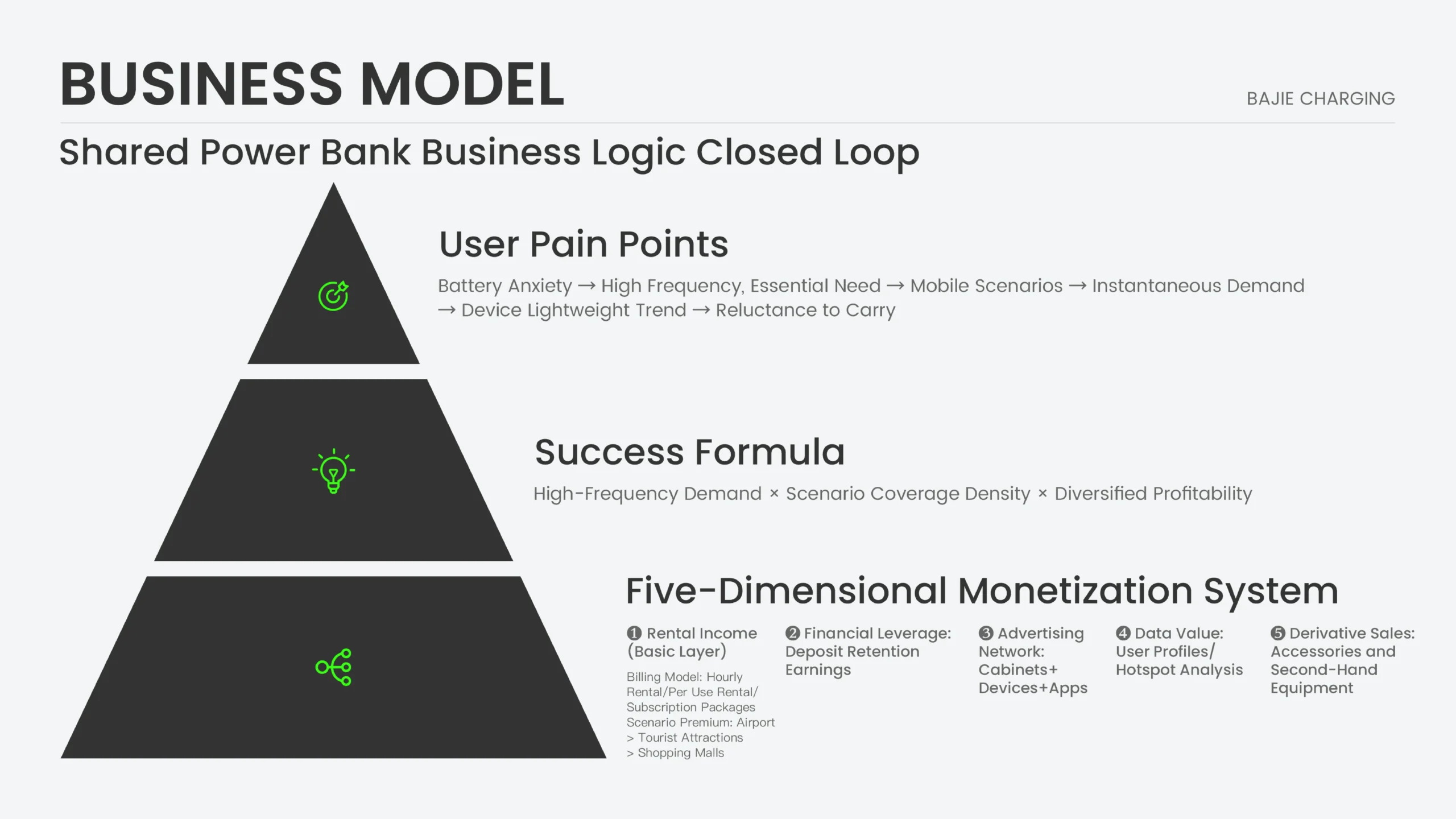

Power bank vending machines are widely deployed in public spaces such as shopping malls and airports, providing users with convenient, instant charging services. Phone charging stations, through a multi-channel profit model that combines rental, advertising, value-added services, data, and product sales, create comprehensive returns for investors. As a business model that has been validated globally, cell phone charging stations attract investors worldwide thanks to advantages such as scalability, economies of scale, and fast capital recovery, making power bank station businesses an appealing investment choice.

1. Beyond rental fees, what profit models can phone charging stations use to enhance revenue security?

The primary source of income for shared power bank rental stations is user rental fees. Although the fee per use is relatively low, mobile phone power banks are deployed across high-traffic locations, and their high usage frequency generates considerable cumulative rental income for investors.

Rental fees are usually calculated by usage duration, number of uses, or subscription packages. Time-based pricing is commonly charged per hour or half-hour. Different scenarios—such as restaurants, shopping malls, and transportation hubs—often adopt differentiated pricing strategies. During peak demand periods (weekends, holidays) or special events, flexible pricing can be applied to increase revenue.

Screens on shared charging stations and in-app placements can display brand advertisements, creating advertising revenue for investors. The phone charging station platform can also leverage data such as rental frequency, usage scenarios, and dwell time to enable more precise ad targeting for partner brands, improving advertising effectiveness and returns.

Deposits collected from users create temporary capital pools. During the rental period, investors can use these funds for short-term investment returns or operational cash flow. Currently, the industry trend is shifting toward deposit-free models, replacing traditional deposits with credit assessments to improve conversion rates and lower usage barriers. In overseas markets involving multiple currencies, pre-authorization payments are commonly used as the primary settlement method.

Value-added service income is mainly realized through in-app services and brand partnerships. Paid services such as coupons, memberships, and local lifestyle information can be offered within the app to increase user engagement and loyalty while generating additional revenue. Partnerships with local service providers in dining, transportation, and other sectors further expand diversified income channels.

The intelligent backend of vending machine power banks can transform user behavior data into commercial insights. By offering foot traffic analysis, precise user profiling, and customized data services, charging station operators can empower partner brands and generate service-based revenue.

Brand accessory sales, old device recycling and refurbishment, and secondary sales form a closed-loop business model of “sales–recycling–resale,” enabling diversified income streams while promoting sustainable resource utilization.

Through multiple revenue channels—rental income, advertising income, deposit income, value-added services, and product sales—shared power bank stations reduce reliance on a single income source, strengthen the risk resistance of the power bank rental kiosk business, and provide investors with more stable and secure returns.

2. Why do investors choose to invest in the cell phone charging locker business?

Power bank rental stations precisely address people’s rigid demand for battery recharging. By densely deploying devices in core consumption scenarios such as dining, entertainment, and transportation, they provide users with instant and convenient charging services. The business model of commercial charging stations is clear and straightforward. Large-scale deployment creates economies of scale, while rental and advertising income generate continuous cash flow.

The payback period for shared power banks is relatively short, with low marginal costs in later stages and strong potential for sustained profit growth, offering significant return on investment.

Fast returns: Through diversified income streams such as rental fees, shared power bank businesses in high-quality locations can typically recover initial investment within 3–6 months, achieving a short payback cycle and high capital turnover efficiency.

Proven model: The business model has been validated globally. Bajie Charging has over 500 successful operating cases, demonstrating the universality and long-term profitability of the power bank station business logic.

Scalable operations: With standardized equipment and operating procedures, the phone charging locker business is easy to replicate and expand. Investors can start with pilot projects and rapidly roll out to new regions or scenarios once proven successful, achieving exponential scale growth.

Stable cash flow: Continuous charging demand creates sustainable passive income. Combined with efficient operations, phone charging vending machine projects can achieve annual returns of over 300%, delivering steady wealth growth for investors.

Summary

Shared power bank rental stations achieve profitability through multiple channels, including time-based rental fees, advertising income, deposit income, value-added services, and product sales. Rental income covers operating costs and enables fast profitability. Partnerships with high-traffic venues allow brand advertisements to be displayed on devices, increasing advertising revenue.

Membership systems and local service offerings generate additional value-added income. Rental deposits form liquid capital that can generate short-term investment returns. Product sales, such as accessories, further broaden revenue streams.

The high-frequency usage, large-scale deployment, and refined management of charging station power banks help investors build strong economies of scale and maximize overall efficiency. The more mobile charging stations are deployed and the higher their utilization rate, the lower the unit cost.

With diversified profit models, phone charging stations enable fast payback in premium locations. Standardized operations make the mobile phone power bank business easy to replicate and expand, while high-frequency market demand delivers continuous passive income and attractive returns for investors.